President Bush tried to warn Congress repeatedly about a pending economic crisis but the Liberal media spun the whole thing out of context.

Read Bush's Warnings... then watch this 2004 video from Congressional Hearing on Freddie and Fannie

Karl Rove's Wall Street Journal Op/Ed President Bush Tried to Rein In Fan and Fred

Mythmaking is in full swing as the Bush administration prepares to leave town. Among the more prominent is the assertion that the housing meltdown resulted from unbridled capitalism under a president opposed to all regulation.

Like most myths, this is entertaining but fictional. In reality, Fannie Mae and Freddie Mac were among the principal culprits of the housing crisis, and Mr. Bush wanted to rein them in before things got out of hand.

Rather than a failure of capitalism, the housing meltdown shows what's likely to happen when government grants special privileges to favored private entities that facilitate bad actors and lousy practices.

Fannie and Freddie are "government-sponsored enterprises" (GSEs), chartered by Congress. As such, they had an implicit promise of taxpayer backing and could borrow money at rates well below competitors.

Because of this, the Bush administration warned in the budget it issued in April 2001 that Fannie and Freddie were too large and overleveraged. Their failure "could cause strong repercussions in financial markets, affecting federally insured entities and economic activity" well beyond housing.

Mr. Bush wanted to limit systemic risk by raising the GSEs' capital requirements, compelling preapproval of new activities, and limiting the size of their portfolios. Why should government regulate banks, credit unions and savings and loans, but not GSEs? Mr. Bush wanted the GSEs to be treated just like their private-sector competitors.

But the GSEs fought back. They didn't want to see the Bush reforms enacted, because that would level the playing field for their competitors.

Congress finally did pass the Bush reforms, but in 2008, after Fannie and Freddie collapsed.

The largely unreported story is that to fend off regulation, the GSEs engaged in a lobbying frenzy. They hired high-profile Democrats and Republicans and spent $170 million on lobbying over the past decade. They also constructed an elaborate network of state and local lobbyists to pressure members of Congress.

When Republican Richard Shelby of Alabama, then chairman of the Senate Banking Committee, pushed for comprehensive GSE reform in 2005, Democrat Sen. Chris Dodd of Connecticut successfully threatened a filibuster. Later, after Fannie and Freddie collapsed, Mr. Dodd asked, "Why weren't we doing more?" He then voted for the Bush reforms that he once called "ill-advised."

But Mr. Dodd wasn't the only Democrat to heap abuse on the Bush reforms. Rep. Barney Frank of Massachusetts defended Fannie and Freddie as "fundamentally sound" and labeled the president's proposals as "inane." He later voted for the reforms. Sen. Charles Schumer of New York dismissed Mr. Bush's "safety and soundness concerns" as "a straw man." "If it ain't broke, don't fix it," was the helpful advice of both Sen. Thomas Carper of Delaware and Rep. Maxine Waters of California. Rep. Gregory Meeks of New York berated a Bush official at a hearing, saying, "I am just pissed off" at the administration for raising the issue.

Democrats had ready allies among lenders accustomed to GSEs buying their risky mortgages. For example, Angelo Mozilo, CEO of Countrywide Financial, complained that "an overly cumbersome regulatory process" would "reduce, or even eliminate, the incentives for the GSEs and their primary market partners."

It took Fannie and Freddie over three decades to acquire $2 trillion in mortgages and mortgage-backed securities. Together, they held $2.1 trillion in 2000. By 2005, the two GSEs held $4 trillion, up 92% in just five years. By 2008, they'd grown another 24%, to nearly $5 trillion. They held almost half of all American mortgages.

The more the president pushed for reform, the more they bought. Peter Wallison of the American Enterprise Institute and Charles Calomiris of the Columbia Business School suggest $1 trillion of this debt was subprime and "liar loans," almost all bought between 2005 and 2007.

This bulk-up in risky paper made it possible for banks to lend imprudently on a massive scale.

Some critics blame Mr. Bush because he supported broadening homeownership. But Mr. Bush's goal was for people to own homes they could afford, not ones made accessible by reckless lenders who off loaded their risk to GSEs.

The housing meltdown is largely a story of greed and irresponsibility made possible by government privilege. If Democrats had granted the Bush administration the regulatory powers it sought, the housing crisis wouldn't be nearly as severe and the economy as a whole would be better off.

That's why some mythmakers are so intent on denying that Mr. Bush worked to rein in the GSEs. But facts are stubborn things, as Ronald Reagan used to say, and in this instance, the facts support Mr. Bush and offer a harsh judgment on key Democrats. Perhaps that explains why so many in the media haven't told the real story.

We Post. You Decide.

Rove, like all Americans, is entitled to his opinions but not the facts. Lets take just two:

ReplyDelete“Fannie Mae and Freddie Mac were among the principal culprits of the housing crisis” Wrong. Fannie and Freddie were cogs in the giant mortgage machine, but they had nothing to do with the abdication of lending standards from 2002-07. That was a function of the Lend-to-Securitize business model of the sub-prime mortgage originators. THAT was the primary cause of the housing boom and bust, along with Ultra-low rates and a lack of Fed regulation of these sub-prime lenders.

Democrats controlled the Congressional Debate on GSEs: Rove somehow fails to note the GOP controlled Congress from 1994-2006, including the first 6 years of the Bush Presidency. If the President wanted to rein in the GSEs, he needed only make it a major priority, and not a footnote in the 2001 budget.

GSEs bought $ trillion of subprime debt and “liar loans,” almost all bought between 2005 and 2007. This bulk-up in risky paper made it possible for banks to lend imprudently on a massive scale. Facts are correct, conclusion is wrong. By 2005, the die was set. The GSEs were very late to the party, buying sub-prime at the top of the market. The peak of homes sales (units) were August 2005, and the peak in prices were in 2006, just a few months later. From there, it was all downhill. By the time the GSE’s were buying sub-prime debt, it was all over but the crying.

Do I think the Democratic Congressmen who took donations from Freddie are blameless? No. Bottom line, this all happened under Bush's watch, the buck stops there.

The buck stops with the President on EVERYTHING?

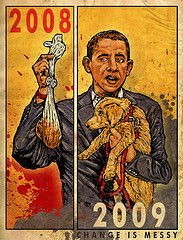

ReplyDeleteOk, we'll keep this in mind from January 20th, 2009 until January 20th, 2013.

If anything goes wrong in America, by your logic, it will be Obama's fault.

I think what the first poster is saying is that if you really forsee a major problem occuring or on the horizon, you should push for changes to be made and continue until you are satisfied or have done all you can. It appears from this article that the only time Mr. Bush "warned" of this was 7 years ago in a budgetary note. Mentioning it once and then letting it drop is something many members of congress can say too and certainly did nothing to help the situation, only gives a soundbite in hindsight.

ReplyDeleteObama is being left a far, far, far worse situation that Clinton left Bush. Just a couple facts - Bush inherited a budget surplus, the projected budget deficit this year (which, for the gov, ends 9/30/09) is $1.2 trillion. Clinton's last budget had federal spending as 18.5% of GDP, the 2008 (that just ended) was 20%. The unemployment rate when Bush came into office was 4%, it is 7.2%. The national debt increased $5trillion under the Bush Administration - it was $5.7 trillion when he came into office.

ReplyDeleteAnd remember, for 6 of the 8 years he had a Republican Senate and Republican House.

I think it is good to have an opposition party and I think for much of the Bush Administration the Democratic party as an opposition party was, to put it generously, ineffective (most words I can think of can't be posted in a family-friendly forum). More push back I think would have been good for the country. Still, fairness requires that we recognize forthrightly the damage done the last 8 years.